Federal and State Tax Credits can add up to $8,046 in EITC Refund

If you worked at all last year, you may be leaving money on the table. Federal and state tax credits, especially the Earned Income Tax Credit (EITC), help low to moderate-income workers and families get a tax break. Claiming the credit can reduce the tax you owe and may also give you a larger refund to make sure you get every dollar you deserve.

For the 2025 tax year, the EITC can be worth up to $8,046 for families with three or more qualifying children. Eligible single filers and heads of household earning under $61,555, or married couples filing jointly earning under $68,675, may qualify. That’s real money back in your pocket and a big reason the Erie County Clerk’s Office is proud to promote United Way’s MyFreeTaxes program.

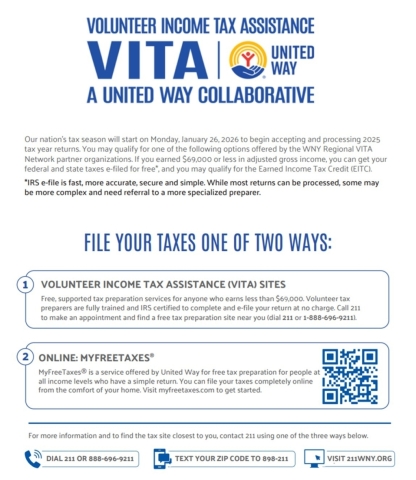

Through a partnership with the IRS’s Volunteer Income Tax Assistance (VITA) program, MyFreeTaxes offers two free options: you can prepare your taxes yourself using easy-to-follow online tools, or you can have your return prepared by volunteer tax preparers, who are fully trained and IRS certified, to complete and e-file your return at no cost to you. This program is a lifeline for low- and moderate-income individuals and families, helping them access critical tax credits and other benefit programs without the stress or expense of professional tax preparation.

The EITC is a refundable federal tax credit created in 1975 to support working individuals and families, reduce poverty, and strengthen the economy. The credit is based on earned income (such as W-2 wages) and typically increases for taxpayers with qualifying children.

Even better—if you were eligible for the EITC but didn’t claim it in the past three years, the IRS encourages you to file an amended return so you can still receive that refund.

To qualify, you must:

- Have earned income under $69,000

- Have investment income below $11,950 for tax year 2025

- Have a valid Social Security number by the due date of your return

- Be a U.S. citizen or resident alien for the full year

- Not filed Form 2555 (foreign earned income)

2025 Earned Income Tax Credit Amounts:

| Number of Children |

Single Maximum Income |

Married Filing Jointly Maximum Income |

Maximum EITC |

| No children | $19,104 | $26,214 | $649 |

| 1 child | $50,434 | $57,554 | $4,328 |

| 2 children | $57,310 | $64,430 | $7,152 |

| 3 or more children | $61,555 | $68,675 | $8,046 |

The IRS estimates that four out of five eligible workers claim the EITC—but millions still miss out. Last year, nearly 24 million workers and families nationwide received close to $70 billion through the credit. The average EITC refund was $2,894 nationwide and $2,753 in New York State. These dollars help families pay rent, buy groceries, cover childcare, and stay financially stable.

Tax season is now in full swing. If you think you may qualify, I strongly encourage you to act now. Have your taxes prepared for free through the IRS’s VITA or Tax Counseling for the Elderly (TCE) programs before the electronic filing deadline of April 15, 2026.

To find a free tax preparation site near you and make an appointment, call 211, text your zip code to 898-211, or visit 211WNY.org. Don’t miss out, every dollar counts, and this credit was designed to help hardworking families just like yours.

Erie County Clerk Michael P. Kearns

Erie County Clerk Michael P. Kearns