Over 5,000 Erie County residents sign petition letters advocating for lowering the excessive 18% interest rate to prevent foreclosures and the proliferation of tax zombie properties.

Erie County, New York- Erie County, New York- Erie County Clerk Michael P. Kearns, in collaboration with the WNY Law Center, proposed a compelling resolution to the Erie County Legislature seeking to Amend the Erie County Tax Act.

By backing this resolution, the Erie County Legislature would strongly urge the New York State Legislature to introduce a bill that will reduce the interest rate in the Erie County Tax Act from 18% to 12%. This change is essential to alleviate excessive interest rates on homeowners while also preventing blight and abandonment throughout all of Erie County.

"As of November 2024, a total of 20 Erie County home-owners owed Erie County approximately $4.5M," stated Kearns. "I also call on the Erie County Legislature to implement a payment plan prior to the foreclosure process."

Research by the Law Center has shown that homeowners in low to moderate income zip codes are particularly vulnerable to the effects of delinquent property taxes. Jordan Modrzynski, Managing Attorney of Housing at the WNY Law Center said, "Our clients are not willingly avoiding their property taxes. Often, people fall behind due to a medical diagnosis, job loss, family emergency, or death in the family. A compounding interest rate of 18% makes it so these homeowners are never able to climb over the wall of debt that accumulates."

It is important to know that the majority of tax delinquent properties are occupied. As of November 2024, a total of 20 Erie County homeowners owed Erie County approximately $4.5 million.

In Erie County, a staggering amount of over $50 million is owed on 7,043 properties by residents who are behind on their property taxes by more than $500. In fact, $18, 991,413.54 is just in interest alone, with one property owner owing Erie County over $750,000. This significant debt not only puts a strain on individual homeowners but also has far-reaching implications for the community as a whole.

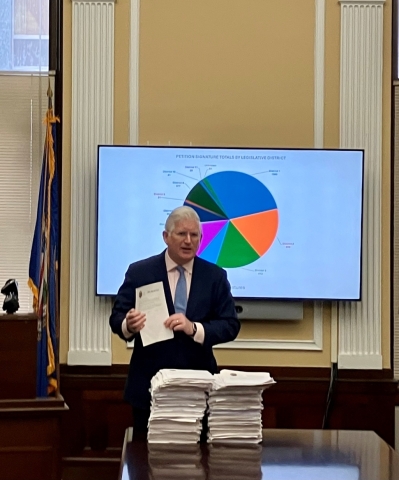

Throughout the summer, Erie County Clerk Kearns and his staff worked tirelessly to address this pressing issue. Recognizing the urgent need for action, they collected over 5,000 signatures in support to lower the exorbitant 18% interest rate that is currently in place for delinquent property taxes.

Kearns added, "Not adopting this Resolution would mean that the steep 18% interest and penalty rate in Erie County would continue to remain unchallenged and that the interest accrued consumes a substantial portion of home equity when that homeowner is eventually foreclosed upon."

Erie County Clerk Michael P. Kearns

Erie County Clerk Michael P. Kearns